Tax Rates Card 2018-19

Following the Spring Statement, below is a 2018 tax rates card 2018-19. The main changes which apply to your business or personal lives are summarised on the tax card. We are sure that you will find it a useful point of reference throughout the coming tax year. We have listed just a few examples of how it can be used below.

The tax card contains lots of useful information such as:

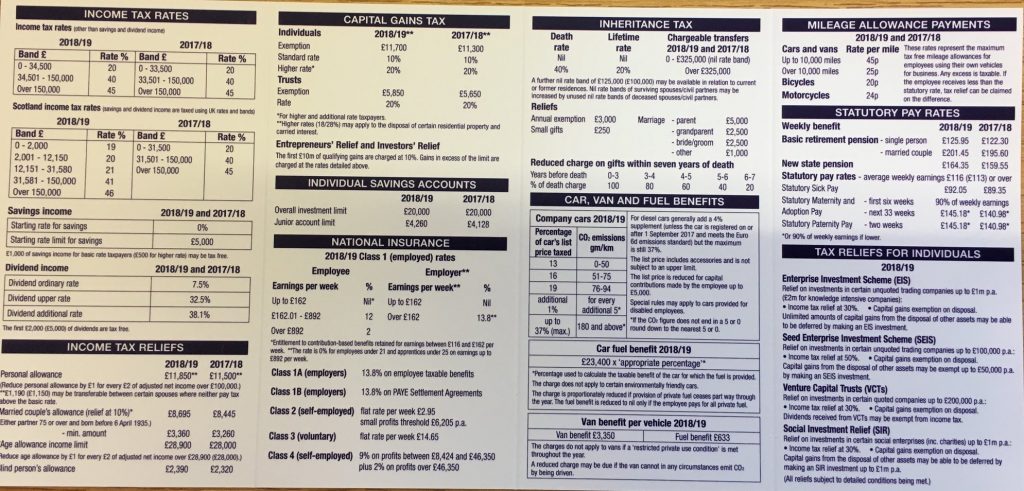

Personal tax rates

A number of changes have taken place to the personal tax rates in recent years, including reduction in the tax free dividends allowance. Make sure you know the current state of play.

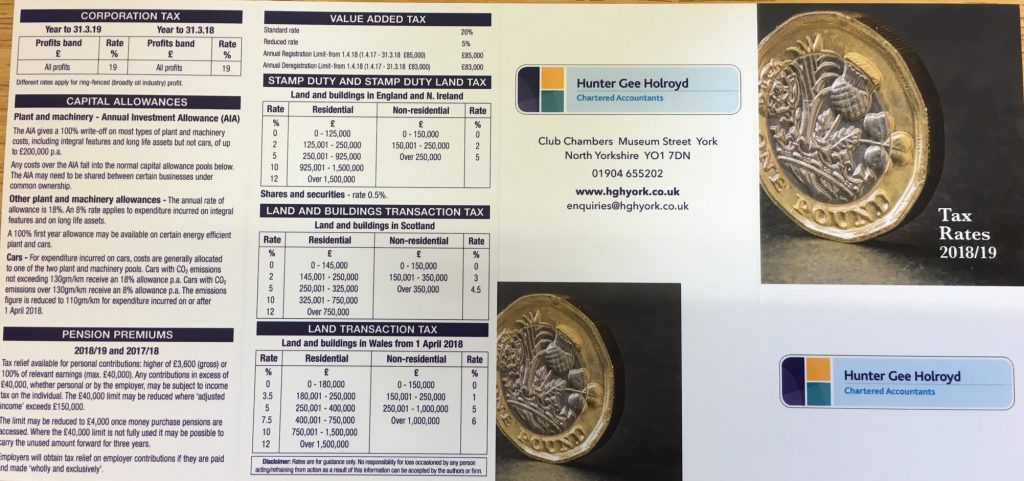

Buying property

If you buy a property in the UK there are changes to the tax you pay depending on where you live. There is Stamp Duty Land Tax in England and Northern Ireland, Land and Buildings Transaction Tax is payable in Scotland and introduced from 1 April 2018, Land Transaction Tax in Wales.

Asset sales

If you sell an asset such as land, capital gains may be due. Our tax rates highlight the main rates and reliefs so that you can consider the tax bill that may arise.

Rates for businesses

If you run a business, obtaining the right allowances on equipment that your business buys can affect the tax that your business has to pay each year. The CO2 emissions that affect the amount of capital allowance due on cars has reduced from April 2018. We have summarised the main allowances that are available.

Rates for employees

There are increases in the company car benefits regime again this year, including an increase in the diesel car supplement. Our guide explains how these are computed to help ensure that you are paying the correct amount of tax.

Travel is a daily part of business life. If you drive your own car on business, HMRC allow certain tax free mileage allowances to be paid. If you are paid less than these rates, you may be entitled to a tax refund. Our guide highlights the rates.

Tax shelters

There are a number of tax reliefs which allow income tax and capital gains tax advantages. Our guide refers to the main reliefs available.

Our tax card is intended for use as a quick point of reference. Should you require any further information, have a simple question or require detailed advice we are only a phone call away.

We are here to help

For assistance with any tax queries, please do not hesitate to contact us on 01904 655202 or email: Nigel.atkinson@hghyork.co.uk, robert.salenius@hghyork.co.uk or paul.morris@hghyork.co.uk.

If you would like a printed version of the tax card, please contact us on 01904 655202.