Pricing and the cost of goods sold

Setting prices is one of the most important things you’ll do as a new business owner. A lot of factors play into the value you put on your products or services. But none is more important than covering your costs.

The first rule of price setting

Not every sale will make you money. Sometimes you’ll sell stock at discount to get rid of it. Or you may have to redo a job for an unhappy client. But as a general rule, you need to get more money out of a sale than you put in to it. To do that, you need to know the cost of the goods sold (also known as cost of sales).

What is cost of goods sold (or services sold)?

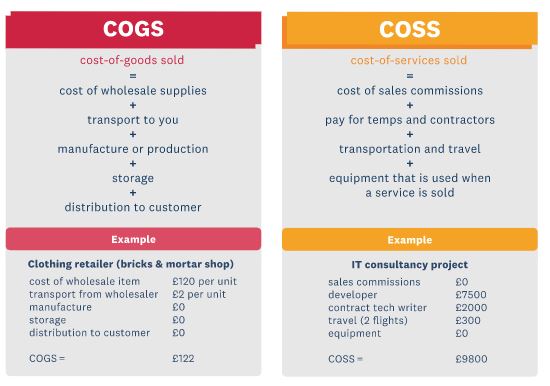

Cost of goods sold, often abbreviated to COGS, tells you what your business spends to deliver products or services to customers. These direct costs are distinct from general operational costs like rent or salaries.

A good way to figure out if something is a COGS is to ask:

- Does this expense occur only when a service or good is sold?

- Does this expense go up and down as sales go up and down?

If either of these answers is “yes”, then it’s probably a COGS. There are many types of COGS and some are hidden, or hard to estimate. If you need help checking, get in touch with the Hunter Gee Holroyd team.

Cost-of-goods-sold formula

These formulas give you a basic intro to calculating cost of goods or services. Your business may not face every type of cost identified. In that case, just put £0.

How to break down shared costs

Some of your costs are shared across jobs or products. For example, you’ll probably have combined transport costs for the products in your shop, one energy bill for your entire workshop, or one piece of equipment that is used on most of your projects. You can distribute a shared cost in one of two ways. You can either:

- share it evenly across each product or project or service you sell, or

- divide it in proportion with other inventory costs (so more expensive products or services carry more of the shared cost).

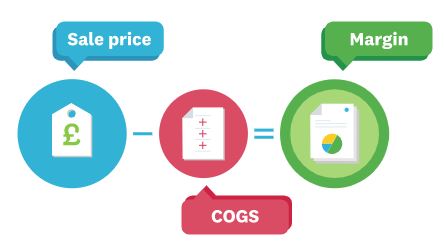

Working out your margin

Once you know your COGS, you can start thinking about a sell price. The difference between your sales price and COGS is your margin.

Some types of business, like supermarkets, can thrive on a margin of just 5% because they make so many sales. Other businesses, such as restaurants, might need a 100% or 200% margin. Margin isn’t profit. You still have to pay for overheads like energy bills and office supplies. You can only bank what’s left after you’ve cleared up those types of expenses.

Pricing factors to consider

Cost of goods sold tells you what your break-even point would be. It’s a huge help to know that when you’re starting a business. But there are many other factors that will play a part in how you price your products or services:

- Value versus cost

You’ve heard people say something is worth more than the sum of its parts. A lot of products and services are like that. If you transform a customer’s life or business, then you have a licence to charge them more – even if it didn’t cost you much to do it. - Supply and demand

If no one else does what you do, and you have lots of customers, you can get away with charging more. Just be wary of pushing it too far. People don’t like to be price gouged and competition will turn up eventually. - Price-taker versus price-maker

Customers have price expectations around certain types of everyday products, and they won’t pay more. If you’re selling an everyday product, you’ll probably have to match the competition. But if your product or service is unique, you can influence or set the price. - Volume versus margin

If your business only makes five sales a week, you want a handsome markup each time. If you make 5,000 sales in a day, you’re probably happier to live with a thin margin.

An introduction to pricing methods

There are dozens of pricing methods out there. Many businesses use a mix of them.

Market-based pricing strategies

Find out what competitors charge for similar products and services, then decide how you want to compare. Even if you don’t use one of these as your primary pricing strategy, your competitors’ activity will always be important.

- Go high, with premium pricing

You can aim to be a brand of choice that customers accept paying more for. You obviously need to sell top-end products or services to be able to do this. - Match the market

By setting your prices at market level, you’re less likely to turn away price-sensitive shoppers. That becomes more important when you’re selling functional everyday goods or services. - Go low, with economy pricing

You can aim to always equal or beat your competition on price and become the go-to destination for bargain hunters. Just be aware that you’re committing yourself to surviving on thin margins, which can be challenging.

Cost-plus pricing strategies

After working out your COGS, you can simply add a standard markup to everything you sell.

- Rule-of-thumb pricing

After decades of trying different things, many industries have settled on standard markup rates. You could start by adopting the relevant rate for your business. - Custom markup

If your industry doesn’t have a standard markup rate, or your market conditions are very different to your competitors, you could pick your own rate. But check your calculations with an accountant before locking it down.

How to start a business with movable pricing strategies

Your prices don’t have to stay constant. In fact a couple of popular pricing strategies for new products and services do just the opposite.

- Penetration pricing

Some startup businesses lower their margin to increase sales volume. This can attract a bunch of new customers fast. The trick is to hold onto them when your prices normalise. - Price skimming

When releasing a new product or service, some businesses open with a high price. They believe the early adopters want the product more, so they’ll pay more. Once the enthusiasts are tapped out, the business drops prices to pick up the rest of the market. - Sweetener deals

A variation on these themes is to set prices high but offer attractive introductory discounts. It allows you to entice customers with a deal without permanently devaluing your offering in their eyes.

Price bundling

Many service businesses like to bundle a few things together at a slight discount. Their margins come down but they bring in more revenue as a result. It’s like giving a bulk-buying deal. You need to do some market research to see what combination of products or services people like.

Pricing methods and COGS are key to profitability

Whatever you do, don’t take pricing lightly. You have two levers for making money in business – margin and sales volume. They’re both affected by price.

Start by working out your COGS. It’s imperative you know how much you spend to get a sale. Plus once you know your costs, you can start finding ways to decrease them. That’s one of the best ways to make more profit per sale.

For further information on pricing methods and using Xero, please contact us on 01904 655202 or email enquiries@hghyork.co.uk.

Source: Xero

This article is for information purposes only and is not intended to be a substitute for professional advice