Major changes to the VAT scheme for construction which HMRC are imposing will begin on 1st March 2021. The reverse charge means that the customer receiving the service must pay the VAT to HMRC instead of the supplier. In turn the customer can recover the VAT, subject to the normal rules for VAT recovery. It is important that you know and understand the changes and plan for them because they may have a large repercussion for your cashflow.

What you need to do to be ready for the start of the reverse charge

- checking whether the reverse charge affects either your sales, purchases or both

- making sure your accounting systems and software are updated to deal with the reverse charge

- considering whether the change will have an impact on your cashflow

- making sure all your staff who are responsible for VAT accounting are familiar with the reverse charge and how it will operate

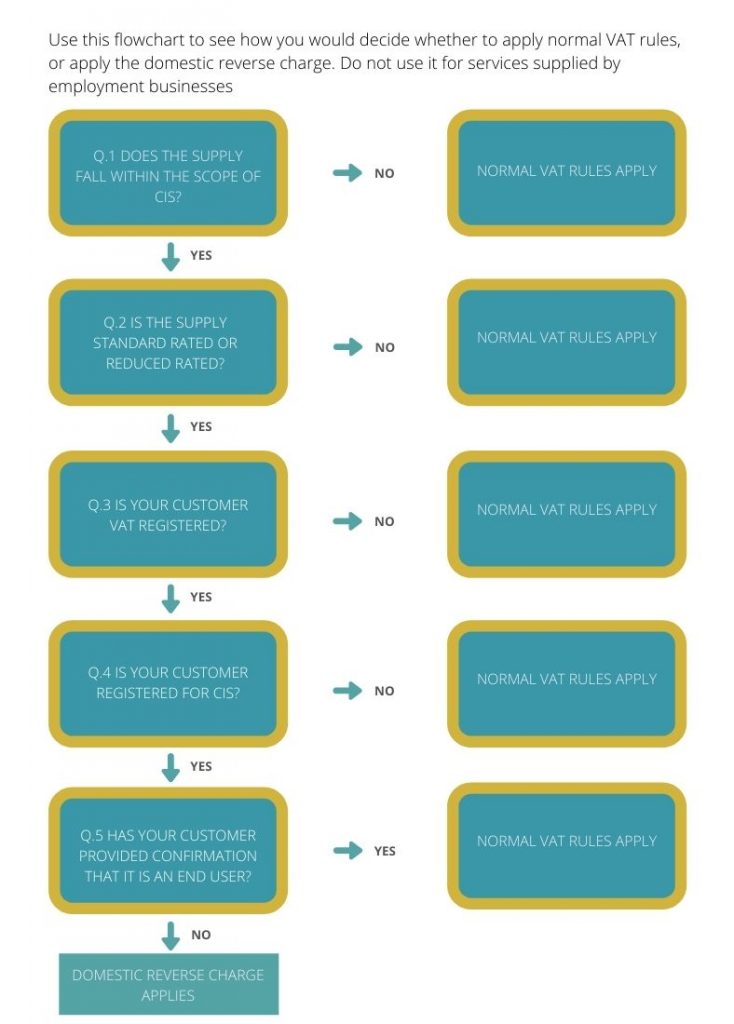

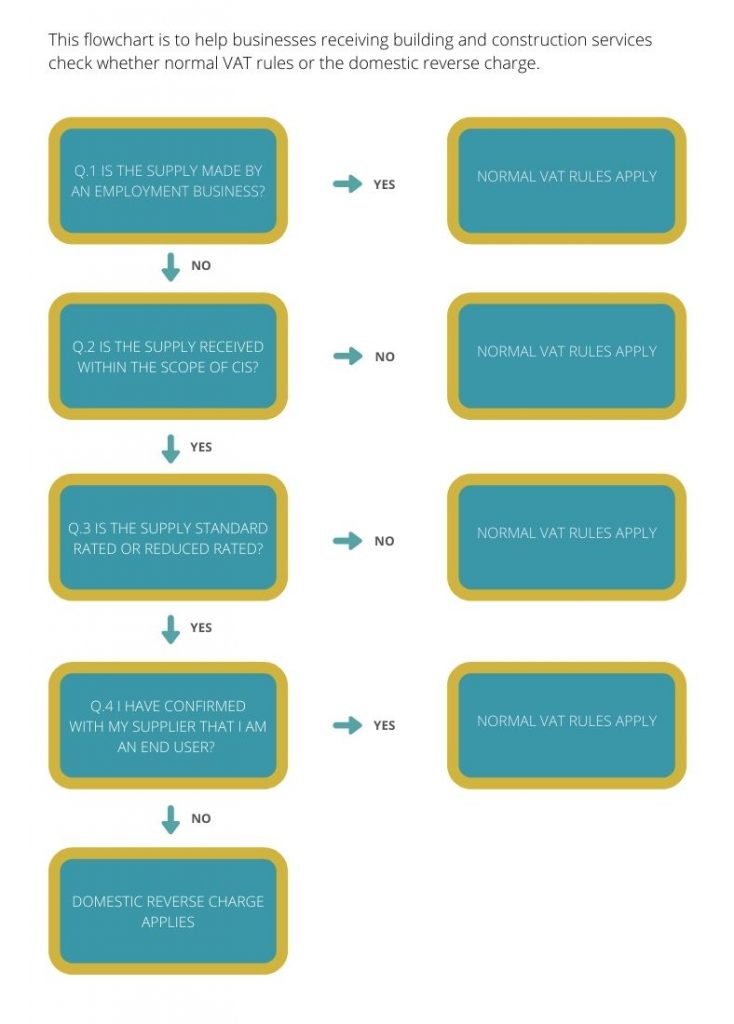

These flow charts can be used to check if the reverse charge will apply:

What contractors need to do

If you’re a contractor you’ll need to review your contracts with sub-contractors, to decide if the reverse charge will apply to the services you receive. You will need to notify your suppliers if the reverse charge applies.

What sub-contractors need to do

If you’re a sub-contractor you’ll need to contact your customer to get confirmation if the reverse charge will apply, including confirmation if the customer is an end user. When supplying a service subject to the reverse charge, suppliers must:

- make a note on the invoice that “customer to account to HMRC for the reverse charge output tax on the VAT-exclusive price of items marked reverse charge”

- clearly state how much VAT is due, or the rate of VAT if the VAT amount cannot be shown, but do not include the VAT in the amount charged to the customer.

How it works

After 1st March 2021 when a sub-contractor does £1,000 of standard rated work for a contractor, and the reverse charge applies:

- The sub-contractor invoices for £1,000 showing the supply as standard rated but NOT adding the £200 VAT to the amount due. The invoice must state “customer to account to HMRC for the reverse charge output tax on the VAT-exclusive price of items marked reverse charge”

- The contractor will pay £1,000 (not £1,200 as now)

- The contractor must enter the £200 reverse charge output VAT in box 1 of the VAT return. There is no corresponding entry required in box 6. The contractor can then reclaim the input tax of £200 in box 4, subject to normal VAT recovery rules. The net value of £1,000 should be entered in box 7 of the contractor’s VAT return.

- The sub-contractor has no VAT to account to HMRC for, as no VAT was charged. The net value of the sale must be entered in box 6 of the sub-contractor’s VAT return.