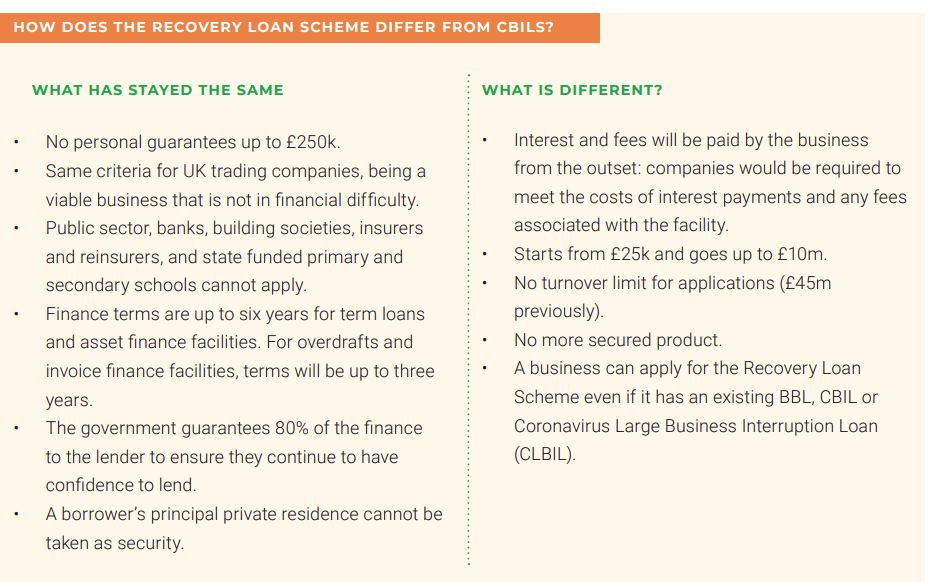

The Recovery Loan Scheme is a government loan scheme that allows qualifying businesses to borrow up to £10 million – either as term loans, overdrafts, invoice finance or asset finance. It replaced the now closed Coronavirus Business Interruption Loan Scheme (CBILS) and Bounce Back Loan Scheme (BBLS).

Recovery Loan Scheme with Capitalise

![]()

Many businesses are eager to get back into the market post-Covid. But with the significant drops in revenue, cash flow and working capital over the pandemic, many businesses will be in a tight cash position and in need of extra funds to kick-start their recovery and long-term prosperity.

Recovery Loan Scheme

It was available from 6 April 2021 and open to UK trading businesses of all sizes. The scheme allows eligible businesses to access up to £10 million in finance, if they meet the eligibility criteria:

- Is trading in the UK

- Is viable or would be viable were it not for the pandemic

- Has been impacted by the coronavirus pandemic

- Is not in collective insolvency proceedings (unless your business is in scope of the Northern Ireland Protocol in which case different eligibility rules may apply.

NOTE: businesses are eligible even if they have already taken out a loan under CBILS or BBLS.

Benefits of the Recovery Loan Scheme

- The Recovery loan Scheme is only available until 31 December 2021, giving businesses a boost to their working capital and the health of their balance sheet.

- Businesses can borrow between £25,001 and £10 million per business in the form of a term loan or overdraft.

- Alternatively, businesses can borrow between £1,000 and £10 million per business in the form of invoice finance or asset finance.

The maximum amount a business can borrow

The maximum facility sizes varies starting at £1,000 for asset and invoice finance, and £25,001 for term loans and overdrafts. The maximum value of a facility per business is the lesser of £10m or 25% of 2019 turnover or double the wage bill of 2019. Anything borrowed under CBILS or CLBILS will count towards a business’ maximum amount. The amount is also subject to a limit of £30m per borrower group.

The agreement to lend is at the lenders discretion.

When the Recovery Loan Scheme might work for you

If you are looking to strengthen your balance sheet and are in need of additional finance, Recovery Loan Scheme is an ideal route to extra funding.

- Aiming to improve your long-term capital position

- In need of a third-party business loan to secure its recovery

- Planning to invest in new assets and equipment

- Looking to fill a short-term cash flow gap

- In need of a new facility to reduce pressures of overdraft use

- Thinking about taking on more staff, or premises, to aid its recovery

- Limited by long payment terms with large amounts of outstanding invoices

How to apply for the Recovery Loan Scheme

You can apply for the scheme on the Capitalise platform, or get in touch with our team.