Types of business structure

When first thinking about how to start a business, not many people worry about structure. But your business structure can affect how you’re treated by the government and by the law. Here are some of the ins and outs.

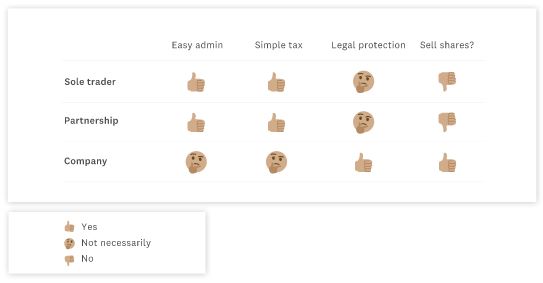

Business structures and their effects

The main types of business structure are sole trader, partnership, and company. Your choice will affect your admin burden, tax, legal status, and your ability to raise money by selling shares. This table runs through some of the main differences between a company, a partnership, and a sole trader.

If you don’t choose a business structure

If you don’t choose a structure when starting a business, you’ll be assumed to be a sole trader. That’s how a lot of people start out. However, it’s worth understanding what it means to be a sole trader, and getting your head around the other structures. Speak to a member of our team before making any changes.

What is a sole trader?

A sole trader is a single-owner business. It doesn’t have to be a single-worker business, so you can hire staff.

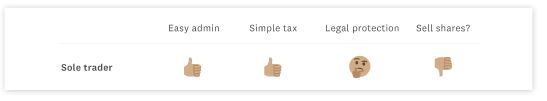

Advantages of a sole trader

It’s easy to set up as a sole trader and tax is simple. You just declare income on your personal tax return.

Disadvantages of a sole trader

A sole trader doesn’t have any special legal status, which means the owner is personally responsible for what the business does. If the business gets into debt or legal trouble, so does the owner. Your choice of insurance becomes very important. A sole trader may also miss out on some tax advantages that come with being a company.

What is a partnership?

A partnership is owned by two or more people. There are no rules about how it’s divided. One partner can own 99% of the business.

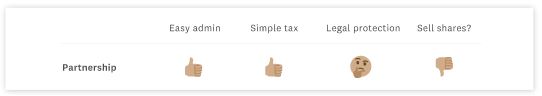

Advantages of a partnership

It’s easy to set up as a partnership, though it’s recommended you have an official letter that sets out the agreement between partners. Tax is simple too. You just declare your share of business income on your personal tax return.

Disadvantages of a partnership

If the business gets into financial or legal strife, the partners do too. You could also get into difficulty if one of the other partners does something wrong. A partnership may also miss out on some tax advantages that come with being a company.

What’s in a partnership agreement

A simple business partnership agreement should:

- state the legal name of the partnership and say what you do

- name the owners and show how many shares each has

- appoint a primary business officer

- say when and how income is distributed among the partners

- include a process for resolving disputes

- identify how bookkeeping and finances will be managed

- outline how the partnership can be wrapped up (and how debts or profits would be distributed)

As you can imagine, even a simple business partnership agreement can get big and complicated. Search the internet for examples or, better still, ask us for help.

What is a company?

A company is legally separate from its owner (or owners), which means you’re less exposed to legal or financial issues. A company can be owned by one person or many.

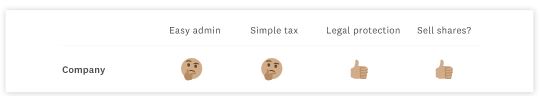

Advantages of a company

You get some legal and financial protection if things go wrong.. Companies pay a lower tax rate and you can choose when to draw income from the business, which gives you more options for lowering your tax bill. You can also sell shares in your company to raise money.

Disadvantages of a company

It will cost you more to operate as a company than as a sole trader or partnership. There’s also more admin. You’ll need to know how the company will operate before you get started, and you’ll have to regularly submit paperwork to Companies House.

You can change your business structure

You’re not locked into one structure forever. A lot of businesses start out as sole traders or partnerships and grow into companies. You might change your business structure if you start getting bigger and doing more complex projects which carry a greater financial or legal risk for you.

Where do franchises fit?

If you buy into a franchise, you don’t automatically become part of their business. You form your own business and enter into a deal with the franchisor. You may be able to choose your own business structure, or the franchise agreement may require it to be set up in a specific way, such as a company.

For further information on business structures and using Xero, please contact us on 01904 655202 or email enquiries@hghyork.co.uk.

Source: Xero

This article is for information purposes only and is not intended to be a substitute for professional advice