Starting a business is a big financial decision. Before you get going, you’ll want to estimate how much money it will go through, and how much it will make. Welcome to the world of budgeting and forecasting.

What is a business budget?

Budgets show how money will come and go from your business over a period of time (usually a year). That money might come in as loans or revenue from sales. It will go out on things like inventory, rent, advertising and wages for you and your staff. Most budgets try to keep spending down to less than what’s coming in, but that might not be the case at first.

The purpose of budgeting

Budgets help you plan to make a profit. For example, they’ll show:

- how much money you need to start the business

- how many sales you need to cover costs

- how much you can afford to reinvest in the business

- when you can afford to hire help

The main purpose of a budget is to help you see where you’re making money, and where you’re spending it. Once you know that, you can try to do more of the making and less of the spending.

Components of a budget

Why a cash flow budget is a good idea

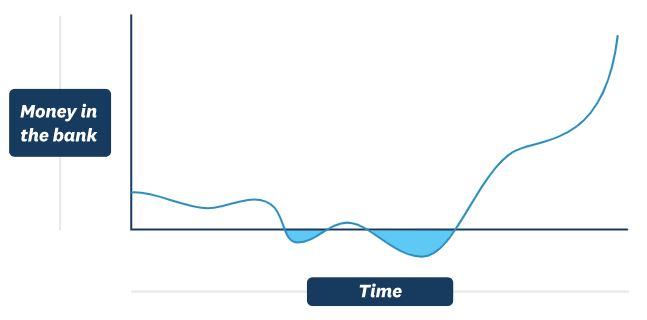

Your profit & loss (P&L) statement and balance sheet are the two most common components of a budget because they show whether or not you’re making money. But a cash flow forecast is also important. It predicts how much money you’ll have in the bank at any one time based on when you expect to be paid and when you expect to have to pay bills or staff.

A lot of new businesses run out of money at some point. A cash flow budget will help you see when those dry spells are coming, so you can plan around them. You might delay an order of supplies, hold off on buying new equipment, or organise a loan or line of credit to get you through.

How to make a budget

Budgeting gets easier the more you do it. You can use one year’s experience to help predict the next. But when you’re first starting a business, you have to make a lot of assumptions. The key is to avoid pure guesswork.

Projected revenue

You’ll need to do some work to:

Projected costs

Estimate what you’ll spend on things like:

- supplies and labour

- work tools such as computers or machinery

- overheads like rent, energy, memberships, or licences

Leave a line for petty cash, to cover costs you didn’t think of.

P&L budget

Once you’ve worked out your revenues and costs, bring them together in a P&L budget. Will the business make more money than it spends? That’s the aim, of course, but you may not be profitable straight away. If you expect to lose money in your first budget, create a separate document that shows when you’ll start turning a profit.

What you own (assets)

Include things such as:

- property, work tools, or vehicles

- cash that the business has in the bank

- money the business is owed (such as invoices that haven’t been paid yet)

What you owe (liabilities)

Count up all the debts you have, such as:

- loans you’re repaying

- repayments due on things like vehicles

- bills you haven’t paid yet

Balance sheet

Some things will appear on both sides of your balance sheet. The portion you own is an asset, and the portion you’re repaying is a liability.

When listing the value of your assets, don’t just write down what you paid for them and forget about it. Most assets lose value over time. This is called depreciation and it gets reflected on your balance sheet. The good news is that you can claim depreciation as a tax break.

7 common budgeting mistakes: what people forget

- Freelancers and contractors

You’ll probably need help with some tasks. Even a business that has its own staff may need contractors to cover leave or busy periods. - Transport

Whether you’re visiting job sites, going to client meetings, or shipping internet orders, you need to factor in transport. - Interest on loans

You don’t just need to repay the money you borrowed. You need to pay the interest too. Figure out what that cost is. - Insurance

You may need several policies to protect your business and the costs will add up. - Wastage

Don’t count on things working perfectly. Boxes will be misprinted. Products will be dropped. Contractors will make mistakes. And you’ll have to do some jobs over. - Taxes

When you first subtract costs from revenue, the difference often looks great – but don’t forget the government gets some of that money. - Depreciation

Most of the things your business owns will lose value over time. You need to account for that or else you’ll get a shock when it comes time to replace them.

The difference between a budget and a forecast

Your budget is a plan for where you want the business to go. A forecast shows where it is actually going based on what’s happened before.

When you first start out, there won’t be any difference between your budget and forecast. That’s because they’ll be built from the same set of estimates and assumptions. But as your business gets going, you’ll start collecting real-life information and you’ll see how sales and costs are going.

By looking at this data, you’ll get a better idea of where the business is headed and you’ll modify your predictions. When you do that, you’re reforecasting. As time goes on, your forecast and budget will probably start to look different. You’ll bring them back together when you do your next budget.

Budget vs actuals (updating your forecasts)

At the heart of good budgeting and forecasting is the reality check. Every so often, compare your budget and all its assumptions against what’s happening.

Some businesses do this every quarter. That may not be realistic given everything else you have going on in your first year of business. But now is when tight budgeting is super important.

At the very least, keep a mental score of budget vs actuals throughout the year. You probably know the numbers so well that you’ll notice if things are going off target. If they do – for better or worse – then take the time to make a new forecast.

Simplify budgeting

Online accounting software makes creating a budget easy. For example, Xero financial reporting automatically compares budget to actuals and produces up-to-date reports, like a profit and loss or balance sheet, whenever you need them.

Manage your business finances easily

For further information on budgeting, forecasting and using Xero, please contact us on 01904 655202 or email enquiries@hghyork.co.uk.

Source: Xero