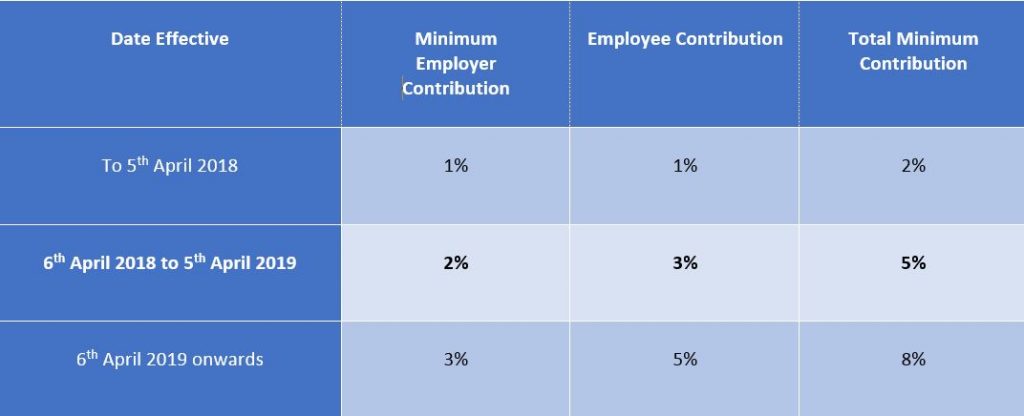

Minimum Pension Contributions will increase on the 6th April 2018, by law.

Pension Contributions will be changing from 6th April 2018.

The minimum contribution percentage for automatic enrolment pension schemes will increase on 6th April 2018.

This increase will happen in two stages, known as ‘contribution phasing’, with the first increase on the 6th April 2018.

The tables below summarise the changes:

Changes to Pension Contributions from 6th April 2018.

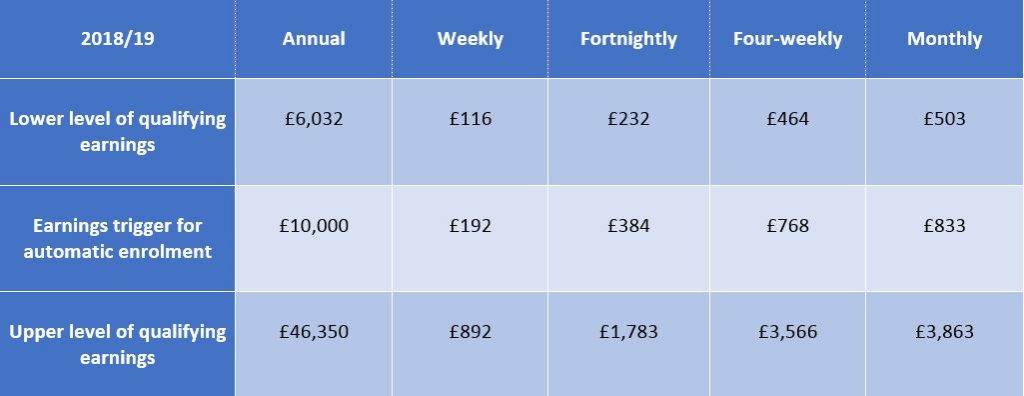

The automatic enrolment earnings trigger will continue at £10,000 per annum, therefore employees earning above this amount will be eligible to pay into your workplace pension scheme. If your pension contributions are based on qualifying banded earnings, between the lower earnings limit and the upper earnings limit, these are increasing per legislation changes for the 2018/19 tax year:

Examples:

- If a monthly paid employee receives gross pay of £1,000, the first £503 will not be pensionable.

- If a monthly paid employee receives gross pay of £4,000, pension contributions will be calculated on the amount between £503 and £3,863.

What do I need to do?

If the current contributions from the employer and employee already meet the minimum requirements for April 2018, you will not have to take any action. You may wish to continue to pay contributions above the minimum levels so that your employees continue to enjoy an enhanced employee benefit*

*Note – if you employ more than 50 employees and are increasing contributions beyond the minimum rate, you will need to consult your employees about the changes and give them 60 days to respond. We advise that employment law advice is taken as this will represent a change to their contractual terms.

Before the end of the tax year, you should receive a letter from The Pensions Regulator to remind you about these increases.

Although there are no additional duties under automatic enrolment for you to tell your employees about the increase to contributions, you may wish to do so. This will help minimise queries and reduce the risk of some employees deciding to opt out of their pension scheme.

If you’d like to find out more

For further information, please contact our Payroll Manager, Clare Walker clare.walker@hghyork.co.uk or call 01904 655202.