Did you know that 91% of financial advisers charge higher fees than HGH Wealth Management Ltd?*

How we are remunerated

Initial Fee – Lump Sum Investments

There will be a cost attached to the services we provide (with the exception of our initial one hour free consultation) and at HGH Wealth Management Ltd we offer you a choice of service and payment options to suit your requirements. We will discuss with and invite you to select the option most appropriate to you.

| £ | % |

|---|---|

| 0 – 50,000 | 3% |

| 50,000 – 100,000 | 2% |

| 100,000 + | 1% |

A minimum level wealth management fee of £500 (£750 for a pension report) will be charged for the preparation of a report detailing our advice to you based on your individual circumstances and objectives. Should you then proceed with our advice, then this report will be offset against the initial advice charge, subject to the minimum fee of £500 (£750 for a pension report). We will ask you to sign a fee agreement form at the end of our initial meeting should you instruct us to proceed with the preparation of a report.

For clients who invest monies of £1million or more with us our fees are negotiable and calculated on a fixed fee basis.

For example:

- Portfolio of £1million – initial advice fee of 1.00% or £10,000 and ongoing annual advice fee of £5,000 per annum.

- Portfolio of £2million – fixed initial advice fee of £10,000 and ongoing annual fixed fee of £5,000 per annum (equivalent to 0.50% initial fee and 0.25%).

Paying for our services

We will discuss your payment options with you and agree how we will be paid. You can pay our adviser charges by cheque: we do not accept debit or credit cards cards or cash. Our charges will become payable upon completion of our work and should be settled within 21 business days. You will be provided with a receipt upon payment. You may also pay our adviser charges by deduction from financial product (s) that you might invest in, where the product/platform provider allows this.

Please note that if you choose to pay by deduction from a financial product, this will reduce the amount left for investment and may, depending on your circumstances, have other consequences. If you select this option, we will discuss the implications of using this payment method with you prior to putting it in place.

If your investments are held on a platform, you may choose to pay our adviser charges out of funds held with the platform cash account (where the provider offers this facility). If this method is selected it is important that sufficient funds are maintained in the account to cover our adviser charges as and when they become payable. We will discuss the implications of using this payment option with you prior to putting it in place.

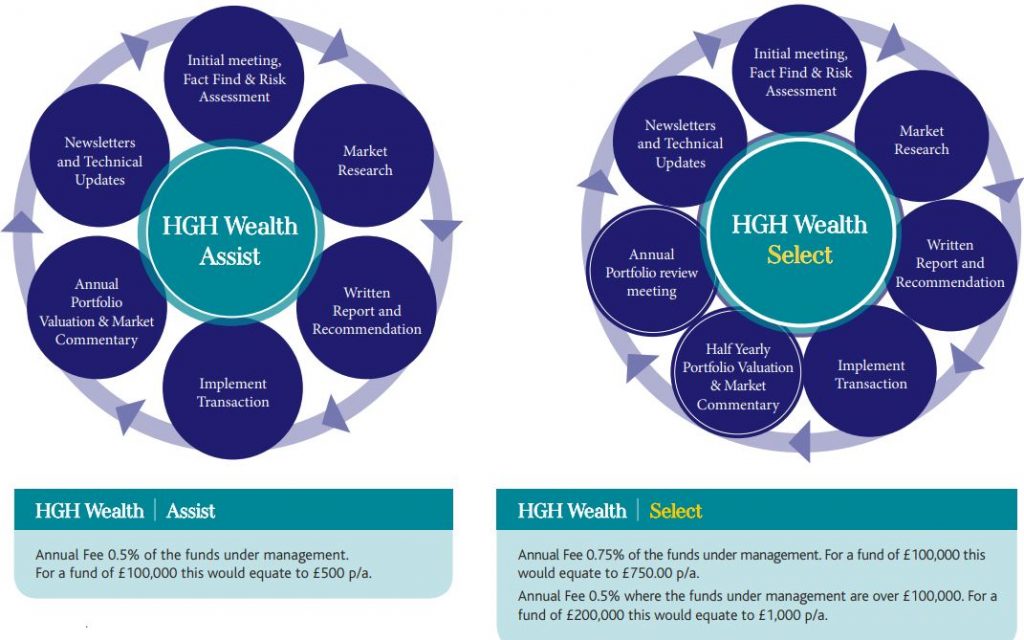

Ongoing Services

Our charges for ongoing services will commence alongside the initial charge and will be levied on a monthly basis if calculated as % of funds under management. These will be disclosed in the suitability report and in documentation issued by the recommended provider or fund manager. Ongoing services may be cancelled at any time by informing us in writing, but please note that we reserve the right to charge you for services provided before cancellation.

Our service levels – investment advice

As the value of assets fluctuate, so will the amount paid to us as your advisers. This ensures our interests are aligned to our mutual benefit.

* According to research undertaken by Vouchedfor, the UK’s leading review site for Financial Advisers.