Coronavirus Job Retention Scheme

Updated – 12 May 2020

The government’s Coronavirus Job Retention Scheme will remain open until the end of October, the Chancellor announced today (Tuesday 12 May 2020).

- furloughed workers across UK will continue to receive 80% of their current salary, up to £2,500

- new flexibility will be introduced from August to get employees back to work and boost economy. From the start of August, furloughed workers will be able to return to work part-time with employers being asked to pay a percentage towards the salaries of their furloughed staff. The employer payments will substitute the contribution the government is currently making, ensuring that staff continue to receive 80% of their salary, up to £2,500 a month. More specific details and information around its implementation will be made available by the end of this month.

The Job Retention Scheme was announced to deal with this specifically. The broad points of the scheme are that the Government, through HMRC, will provide a grant of the lower of 80% of the employee’s wage costs or £2,500. This will cover an employee’s costs of employment provided they are placed on furlough leave. Furloughed leave is new but essentially means that employees retain their employment but do not work. An employee must be furloughed for a minimum period of three weeks for the grant to apply. Employment Law still applies to them and the process of furloughing and therefore it is essential that advice is taken before you proceed with this measure to ensure that you follow the correct procedure.

The Job Retention Scheme is a really important tactic for businesses looking to retain good employees and save cash. We’ve updated our notes on the scheme, which is copied below for reference.

HMRC are developing a system that will allow employers to provide this information through an online portal and once processed they will issue reimbursement. The portal will be open from 20th April and HMRC have stated that they hope businesses will receive monies before the end of April. HMRC communications have stated:

“Businesses, and agents that are authorised to act on behalf of clients for PAYE matters, will be able to claim. However, file only agents, including Payroll Bureaus, will not be able access the service due to data protection reasons.

“Businesses will need the following information on each of their furloughed employees:

- National Insurance number

- salary, National Insurance and pension contribution information that allows business to calculate the claim amount.”

Clearly, this is an enormous task for companies, accountants and HMRC and the commitment to release all grants by 30th April appears optimistic. Therefore, managing cash during this intervening period is still crucial (see our advice about cashflows later in this guide).

Careful planning and consideration of employee’s contracts of employment is required when considering this scheme but it is certainly a significant boost to companies in what are unprecedented times.

Further guidance

Following a meeting with HM Revenue & Customs (HMRC) the Institute of Chartered Accountants in England and Wales (ICAEW) have issued some notes on how they believe the Coronavirus Job Retention Scheme will work.

The notes below provide an update to our original piece published earlier in the week which is copied below for reference.

Updates

- HMRC will be the body that administers the grant scheme.

- Now confirmed that Charitable and not for profit organisations will be eligible.

- Whilst the scheme is backdated to the 1 March grants will only be available when employers have agreed furlough terms with their employees and they have stopped work, subject to employment law in the usual way.

- Available to all employees on the payroll at 19 March 2020.

- The employer will pay the employee through payroll and as such RTI submissions will still be maintained. This actually makes a lot of sense as it is a system that already works well.

- Relevant employees must be designated as furloughed employees.

- The scheme will not cover dividends where directors/ shareholders of owner managed companies pay small salaries and the balance as dividends.

- The grant will cover all employment costs including; salary, employer pension contributions and employer NIC.

- The grant will be taxed and should be included in the profits computation for the relevant year.

- The updated guidance also clarifies that individuals who were employed on 28 February, but who were made redundant and prior to 19 March, also qualify for the scheme if the employer re-employs them and puts them on furlough.

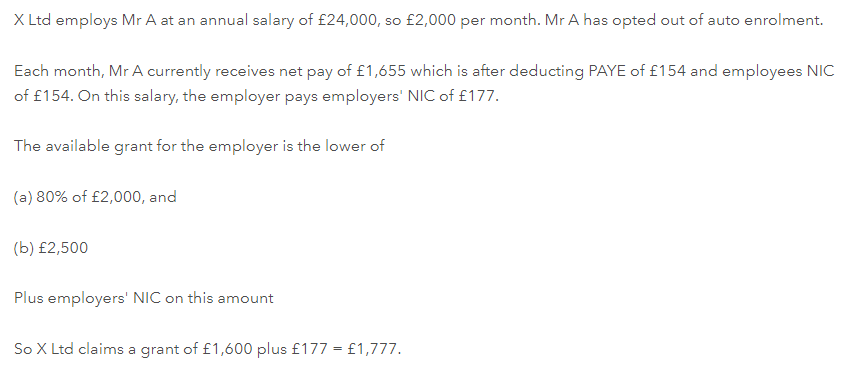

Illustration

Illustration (taken from the ICAEW article) shows how the grant would be calculated. Note assumes no pension payments. If a pension was paid (i.e. Mr A was opted in) the grant would cover this too being 80% x (£2,000 + £174 + Ers Pension) subject to the £2,500 cap. Note that the Ers NIC and Pension will be calculated using the new 80% salary as reference.

The original ICAEW article can be found here

Information you will need before you make a claim

You will need to have the following before 20 April 2020:

- a Government Gateway (GG) ID and password – if you don’t already have a GG account, you can apply for one online, or by going to GOV.UK and searching for ‘HMRC services: sign in or register’

- be enrolled for PAYE online – if you aren’t registered yet, you can do so now, or by going to GOV.UK and searching for ‘PAYE Online for employers’

- the following information for each furloughed employee you will be claiming for:

- Name.

- National Insurance number.

- Claim period and claim amount.

- PAYE/employee number (optional).

- if you have fewer than 100 furloughed staff – you will need to input information directly into the system for each employee

- if you have 100 or more furloughed staff – you will need to upload a file with information for each employee; we will accept the following file types: .xls .xlsx .csv .ods.

HMRC advise that business owners will need to calculate the amount you are claiming. However, HMRC will retain the right to retrospectively audit all aspects of a claim.

HMRC advise that claims can be made using payroll data either “shortly before or during running payroll.”

How much you can claim?

- 80% of your employees’ wages up to a maximum of £2,500.

- Minimum automatic enrolment employer pension contributions on the subsidised wage.

- Grants will be prorated if your employee is only furloughed for part of a pay period.

- Claims should be made from the date the employee finished work and starts on furlough leave, not when the decision is made or they were written to.

- Employers National Insurance contributions.

Funding problems

One of the problems with the scheme is the delay in being able to make claims and receive funds. If an employee was furloughed on 20 March there could be 11 days available for the March claim.

The employer would need to pay the employees net pay on 31 March and 30 April well before potentially being able to make a claim in early May for receipt sometime in mid to late May. Whilst we can’t be sure this will apply for all businesses, Banks may be willing to extend or arrange overdrafts for a limited time for the amounts expected to be claimed.

Updated 26th March 2020: The Government has announced a new scheme to protect people’s jobs during the crisis. The scheme is open to all UK businesses and will see the Government pay part of the wages of employees that would otherwise have been laid off. The scheme will be will be open for an initial three months from 1 March however Rishi Sunak said “… and I will extend the scheme for longer if necessary”.

This is a grant from the Government, not a loan, so it will not need to be repaid. Under the new Coronavirus Job Retention scheme, government grants will cover up to 80% of the salary of PAYE employees who would otherwise have been laid off during this crisis. The scheme, open to any employer in the country, will cover the cost of wages backdated to 1 March 2020 and will be open before the end of April. It will continue for at least three months, and can include workers who were in employment on 19 March 2020 Employees still working, full time or part time or on shorter hours will not qualify

To access the scheme employees, or certain employees, need to be designated as “furloughed workers”. You will need to notify these workers of the change, in writing (email will be fine) making sure you follow a fair selection process. It’s worth noting that the Government is not changing employment law to allow this to change in status. Therefore, making this change to an employees status remains subject to employment law. We have put together an example ‘Agreement for Furlough Leave‘ letter that you may wish to download here.

You have the option of topping up the remaining 20%, but it is not mandatory.

To claim under the scheme employers will need to:

- designate affected employees as ‘furloughed workers’, and notify employees of this change. Changing the status of employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation; and

- submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal. HMRC will set out further details on the information required.

- HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of £2,500 per month.

While HMRC is working urgently to set up a system for reimbursement, we understand existing systems are not set up to facilitate payments to employers. Businesses that need short-term cash flow support, may benefit from the VAT deferral option and may also be eligible to apply for a Coronavirus Business Interruption Loan.

HMRC are developing a system that will allow employers to provide this information through an online portal and once processed they will issue reimbursement. Managing cash during this intervening period is still crucial (see our advice about cashflows later in this guide).

It should also be noted that the employee should be shown on the February pay run and that a claim will be possible for periods from 1 March 2020. It is not clear yet how much those on zero hours’ contracts or fluctuating wages will be treated, but it is expected that it will be either the amount which was paid through last month’s payroll or an average of the past few months. Careful planning and consideration of employee’s contracts of employment is required when considering this scheme but it is certainly a significant boost to companies in what are unprecedented times.

N.B. It should be noted by employers that in order for you to be able to claim a grant of 80% of wages for all employment costs (up to a cap of £2,500 per month), furloughed employees should not undertake any work for you.