Are you prepared for the 2019/20 payroll changes?

Posted: 27th Mar 2019 by Clare Walker Blog

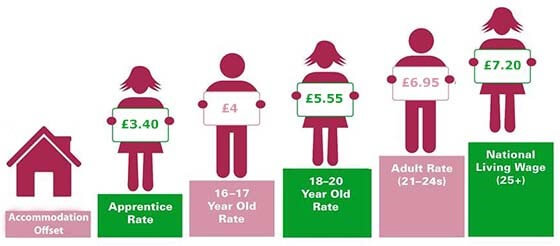

The new payroll year begins April 2019 and employers should be aware of the following changes: Income Tax National Insurance Employment Allowance Student Loan Repayments Postgraduate Loan Deductions Starter Checklist Statutory Payments Minimum Wage Payslips Tax-Free Childcare Schemes Automatic Enrolment Income Tax allowances The basic personal allowance for the tax year commencing 6th April 2019… Read more